Your Gateway to Global Business: A Guide to UK Company Formation for Foreign Entrepreneurs

The United Kingdom has long been a beacon for international business, attracting entrepreneurs from across the globe with its robust economy, prestigious reputation, and straightforward regulatory environment. If you’re a foreign entrepreneur eyeing the global market, setting up a company in the UK could be your smartest strategic move. This article will walk you through the essential steps and key considerations for forming a company in the UK.

Why Choose the UK for Your Business?

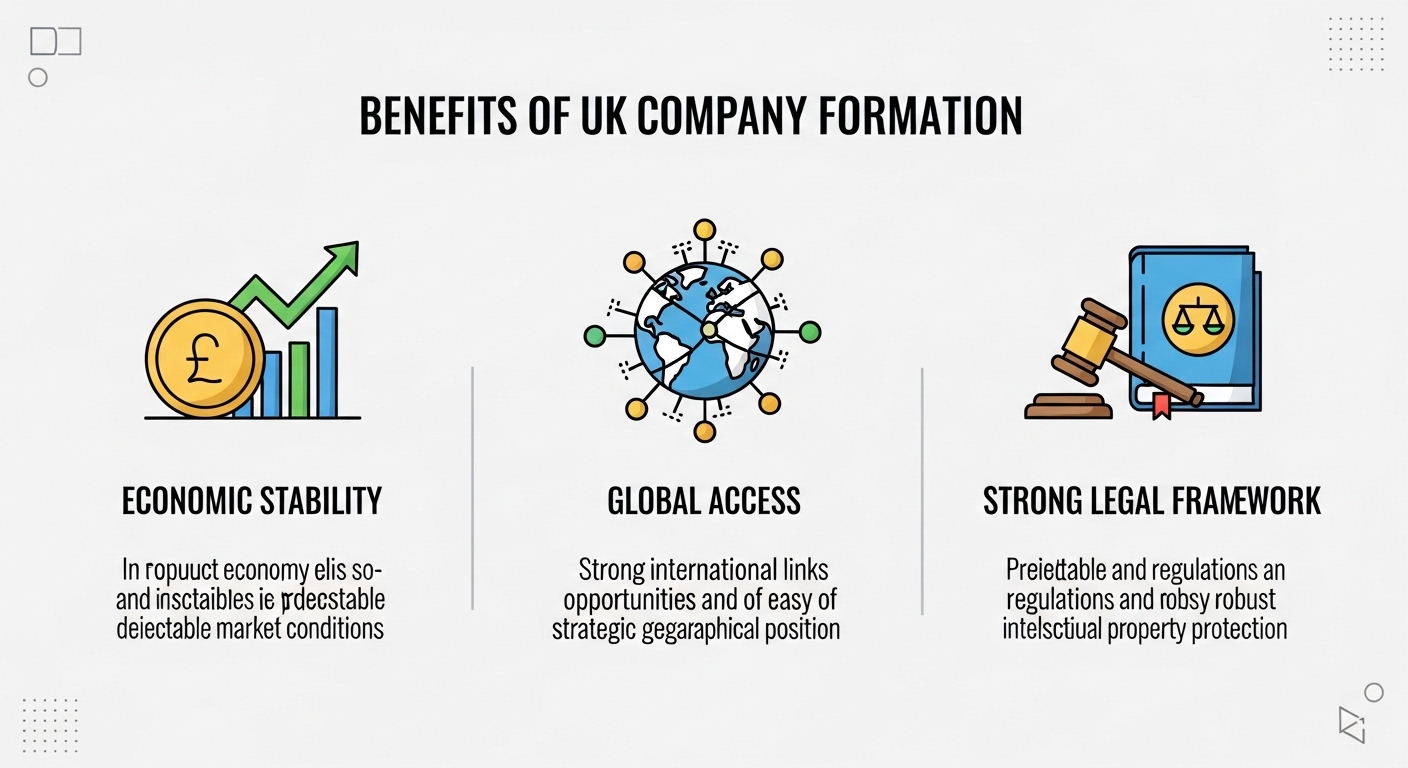

There are numerous compelling reasons why foreign entrepreneurs gravitate towards the UK:

Economic Stability and Global Influence

The UK boasts one of the world’s largest and most stable economies, offering a predictable and secure environment for business operations. Its long-standing position as a global financial hub means unparalleled access to international markets and investment opportunities.

Business-Friendly Environment

The UK government is committed to fostering a pro-business climate. This includes competitive corporation tax rates, numerous incentives for startups and innovation, and a legal framework that is both transparent and highly respected worldwide. The ease of doing business here is a significant draw.

Access to Talent and Innovation

With world-class universities and a diverse, skilled workforce, the UK is a melting pot of talent and innovation. Businesses can tap into a rich pool of professionals across various sectors, from technology to finance, ensuring a strong foundation for growth.

Understanding UK Company Types

For most foreign entrepreneurs, the primary choice will be between a private limited company and, less commonly, a limited liability partnership.

Private Limited Company (LTD)

This is by far the most popular choice for businesses in the UK. An LTD offers limited liability protection to its shareholders, meaning their personal assets are protected from business debts. It requires at least one director and one shareholder (who can be the same person), and a registered office address in the UK.

Limited Liability Partnership (LLP)

An LLP combines the benefits of a partnership (flexibility in internal organization) with the limited liability protection of a company. It’s often favoured by professional service firms, such as legal or accounting practices.

The Company Formation Process: A Step-by-Step Guide

Setting up a company in the UK is surprisingly straightforward, especially when compared to many other jurisdictions. Here’s a general overview:

1. Choose a Company Name

Your company name must be unique and not already registered or too similar to an existing name. You can check availability via the Companies House website.

2. Appoint Directors and Shareholders

For an LTD, you need at least one director and one shareholder. There are no restrictions on nationality or residency for directors or shareholders, making it highly accessible for foreign entrepreneurs.

3. Establish a UK Registered Office Address

Every UK company must have a registered office address in the UK. This is where official communications from Companies House and HMRC will be sent. Many service providers offer virtual office solutions if you don’t have a physical presence.

4. Prepare Constitutional Documents

This primarily involves drafting the Memorandum of Association and the Articles of Association. The Memorandum states the subscribers’ intention to form a company, while the Articles outline the rules for running the company.

5. Register with Companies House

Once all documents are prepared, you submit your application to Companies House, the UK’s registrar of companies. This can typically be done online and often completed within 24 hours.

6. Open a UK Business Bank Account

After registration, you’ll need a business bank account. While this can sometimes be challenging for non-residents without a physical presence, many banks and fintech solutions cater to international clients.

7. Register for Corporation Tax

Once your company starts trading, you must register for Corporation Tax with HMRC (HM Revenue & Customs) within three months.

Key Considerations for Foreign Entrepreneurs

While the process is designed to be accessible, there are specific points foreign entrepreneurs should keep in mind.

Visa and Immigration

Forming a UK company does not automatically grant you the right to live and work in the UK. You will need to apply for an appropriate business visa, such as an Innovator Founder visa, if you intend to relocate and actively manage the business from within the UK. Consult immigration experts for tailored advice.

Tax Obligations

Understand your company’s tax obligations, including Corporation Tax, VAT (Value Added Tax) if applicable, and potentially PAYE (Pay As You Earn) if you employ staff. Seeking advice from a UK-based accountant is highly recommended.

Professional Guidance

Engaging with professional services — company formation agents, accountants, and legal advisors — can significantly streamline the process and ensure full compliance. They can guide you through nuances, from choosing the right company structure to navigating ongoing regulatory requirements.

Conclusion

Forming a company in the UK as a foreign entrepreneur is a strategic move that opens doors to a vast network of opportunities. With its stable economy, supportive business environment, and straightforward company formation process, the UK remains an incredibly attractive destination for ambitious global entrepreneurs. By understanding the steps involved and preparing adequately, you can successfully establish your presence and thrive in this dynamic market. Don’t hesitate to seek expert advice to make your UK business venture a resounding success.